First you need to make sure you're watching the price action for a while, it is like a surfer who watches the beach, the break zones, observes the current, stretches and only then goes into the water.

I remember clearly this time in Santa Catarina, Brazil, when I got the board and dove in the water.. It was a new beach, the water was choppy, the waves were big and I had no clue about the currents... Didn't stretch, so guess what I got? My right leg cramped so much I could not swim, had to float and hope I'd go back to shore... With the analogy, this trade bellow blew me out of the water right away.

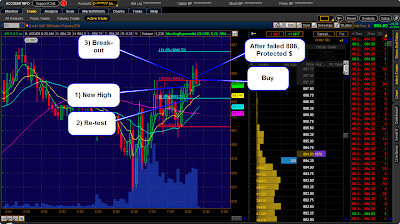

Got back in the swing, played a few small trades, was very careful with my stops and quick to cover as the market was choppy.

Once I noticed this trade wasn't going anywhere, I pushed my stop to get me out with a tiny profit. If I didn't cover the market would hit my stop for a loss.

No comments:

Post a Comment