Sunday, September 13, 2009

09/13 Daiy Trading on hold

So, I replaced the intra-day time with backtesting options trading. This allows me to stay in trading mode, but with the limited time I don't feel overwhelmed trying to do too many things at once.

As time goes by I expect to resume day-trading, but for now, feel free to follow my options trading blog/Journal for what I'm doing daily.

take care!

Gustavo

Friday, August 21, 2009

08/21 Day Trading FOREX

I'll be out next week, so will use the time to refine my goal, strategies, etc.

Cheers!

Gustavo

Thursday, August 20, 2009

08/20 Day Trading FOREX

Next week won't be day trading due to a conflict training I have scheduled in the mornings.

I have been video recording my trading sessions with camstasia. This has helped me a lot when I do a daily review. It also saves time and allows me to record my audio, which helps me to assess my state of mind when I took the trade and specially to flag if I'm trading "in the zone" or frustrated..

1) Long GBP/USD: This is the breakout trade, GBP failed to continue and faded back to hit my stop. -1.21% ROI

Wednesday, August 19, 2009

08/19 Day Trading FOREX

1) Short GBP/USD: Took the sell after we broke down and seemed to be in a continuation mode. The retracement happened inside the 5-min candle, I took the entry but when was placing the limit order, ended up making it a market order and closed the trade much sooner than the target. Luckly it was profitable. +0.02% ROI

Tuesday, August 18, 2009

08/18 Day Trading FOREX

So, I clearly have to improve in staying focused, Today I had two trading mistakes torwards the end of the day. It happens to everyone, I got really frustrated with myself, but this is a good example of what to avoid when trading.

1) Managing Exits: C (Cut my stop too close to the action on the last trade of the day)

2) Trade Set-up: C (Big mistake taking the GBP trade with the 1hour support line)

3) Big-picture assessment: A+

1) Short GBP/USD: This set up had room to go, it triggered and then immediatelly backed off hitting the stop. So far so good, no mistake on my part, simple cost of doing business. -0.87% ROI

2) Shor EUR/USD: This was an announcement trade, I took the reversal in the 1 minute chart, it performed as expected, going to the previous low. I had the entry order too far bellow the propper entry and ended up taking 1/2 of the profits. +0.53% ROI

3) GBP/USD: This trade happened at the same time I took the EUR/USD post-announcement trade. I was not observing a KEY factor against the trade: Notice the dashed white line, it represents the 62 EMA on the 1-hour chart. I did toggle bettwen the 5 min and 1 hour chart, but at the time my 1-hour chart was not properly set up and I thought the dashed line was a mistake on my part. This is a trade that I usually avoid, for a very clear reason, so it was a trading mistake on my part. -0.94% ROI

4) Long GBP/USD: Last trade of the day, I was almost certain we would visit the higher portion of the chart, but GBP/USD backed off. Here is my mistake: I moved the stop too close to the previous candle's low, it was hit. If I had stayed in the trade and managed it as planned, it would have performed to the target as I had expected. But at this time I was not trading in my best. -0.97% ROI

Monday, August 17, 2009

08/17 Day Trading FOREX

1) Managing Exits: B (While I made a mistake on the 1-min trade, I did excelent well on the GBP/USD trade)

2) Trade Set-up: A+

3) Big-picture assessment: A+ (Noticed very clear bounce point on GBP/USD, was looking for short opportunities)

1) Short GBP/USD: I noticed we were fading the top on the GBP and wanted to get on the post-announcement move. I failed to manage the stop on the trade, it was a 1-min chart so the action was fast and I didn't stay on top of it. One way or another, the next time this happens I'll be on top of my exit. If I had exited early enough, for a small loss, I'd still have energy to re-enter the trade a few minutes later when another fading set up showed up and worked. -0.96% ROI

2) Short GBP/USD: Here I managed the exits properly! I stayed on top of the trade and kept moving my stop. It took a lot of focus not to hit the exit sooner than the planned limit, specially after the EUR/USD trade failed. But I'm proud to say I stayed in the trade as per my plan. +0.94% ROI

Sunday, August 16, 2009

08/16 Tracking the right stuff

Trading, like any other business, needs a sound planning and monitoring approach in order to be successful. As a business owner, you need to focus on the right things in order to succeed!

Imagine you just opened a bakery. You make several types of bread, you don't really pay attention to which bread sells more, or which one the customers preffer, you just make them in many sizes and types to fill out your shelves so they look pretty.

Every day, you throw away old stale bread.. And you make some more in the next morning. Fill up your shelves, make them look pretty. Run a business like this, and I can make sure you'll run it to the ground really quick. As a baker, you need to know what your customers preffer, what sells more! And you make more of those types of bread, and less (or none) of the ones you end up throwing away in the end of the day. That should be the focus, not making the shelves look pretty, right?!?! You bake simple bread that sells and then buy some other stuff to make your shelves look nice.

How does it compares to trading?!?! In my case, I'm traking a few metrics every week, two of them are the most important ones in my mind: Risk to reward ratio and win-loss ratio. The combination of those two will tell me if I can make money on the longer run.

Well, here comes the trick! Which one do you, as a trader, think is more important?? Which one should you work on improving? The risk to reward or the win-ratio??

The win-ratio makes you look pretty! WOW, this guys wins 80% of his trades! He is a millionnaire!! NOT SO Quick buster!! If his risk to reward is horrible, say 20 to 1, he is certain to lose money in the long run. See my previous posting on risk to reward to understand why.

I made a small tweak on my trading to avoid taking a small loss when price approached the target and reverted back to break-even. This was an adjustment based on one week of trading where I had one or two trades that I closed at a small loss even after they were profitable. Well, this was not a good idea after all! The reason is simple: by cutting the trade short, I run the risk of cutting a few winning trades too soon, yes, I improve my win-ratio, but at the same time I cut my risk to reward way low!!

This week is an example, my risk to reward ratio came down from being 1:1 (or better) for 4 weeks in a row to a horrible 3:1!! I certainly do not want that type of set-up for my trading. I certainly don't care to look good (being the guy with a huge win-ratio), I much preffer to make money! Even if I make money by winning a small percentage of the time. Who cares?!?! So, I'm reverting back to my original trading plan, where I manage the stops and leave the take profit level alone.

I'll keep on tracking the scenarios where a trade fades from the limit and fails back to being stopped, but will only track those and eventually, when I have a lot more data to go by, will come up with another idea. For now, the simpler the better.

Cheers!

Gustavo

08/16 Weekly Review

It all came together for me when I reduced my size and traded "in the zone" during the FMOC announcement! This gave back my swing and I was able to trade great for the rest of the week. It also helps to have good information to read, and I have to say that the "Daily Trading Coach" book and the Traderfeed blog are a must have for any trader! Thank you Dr. Steembarger!

Trading the FMOC with reduced capital was the only way I could get my head back in the game. Yes, it didn't help with my profitability, but HEY, it got me back in the game and YES it helped! On the longer run, getting myself confortable with my ability to trade is worth a lot more than a few percentage points of profits during one single week. So, one must always put things into perspective.

Increasing my focus by reducing the number of currency pairs I follow was another benefit this week! I now can really concentrate on what is going on in the GBP and EUR, instead of trying to chase set-ups here and there and everywhere. This makes a huge difference!

Day-by-day review:

08/10 - 2 trades, 2 losses (-2.18% ROI)

08/11 - 1 trade, 1 loss (-0.46% ROI)

08/12 - 4 trades, 3 losses (-2.85% ROI)

--- FIXED MY HEAD, got back in the game

08/12 FMOC - 3 trades, 3 wins (+2.16% ROI)** SMALLER SIZE

08/13 - 2 trades, 2 wins (+1.09% ROI)

08/14 - 3 trades, 3 wins (+1.37% ROI)

Totals for the week:

15 trades, 8 wins, 7 losses (-2.98% ROI ** Not compounded)

Average Win: 0.33%

Average Loss: -1%

Risk to Reward ratio: 3 : 1

Winning Percentage: 60%

The risk to reward is not good at all. This is a direct result from having too many trades "scratched", when they failed to reach the targets and fade back to their original entry. I will have to keep an eny on this to make sure it is worth scratching, or if it is better to simply take the risk of hitting the stop, but leaving the target alone.

Trading Performance Metrics

1) Trade set-up: B (Jumped the gun on the 08/12, manual entry errors)

2) Managing Stops: B (Did not manage stops well on 08/11, managed very well after the 12th)

3) Capital Allocation: A+ (Managed properly, reduced size on FMOC as planned)

4) Managing Exits: A+ (Kept a good grip on trades that faded the target)

** Results are not compounded because during the FMOC trades I traded close to nothing in terms of capital at risk. I was basically getting my self back in the game and didn't want any performance pressure. If I had traded those trades with the same level of risk, the results would have been a lot better (-0.98% ROI).

Friday, August 14, 2009

08/14 Day Trading FOREX

That is the complete opposite as to how I was trading early in the week. What happened? I cleared my head about the recent increase in size, I freed myself from performance pressure, and I increased my FOCUS by reducing the ammount of currency pairs I'm trading. In this case, Less is More!

1) Long GBP/USD: This is a great lesson on plan the trade, and trade the plan, Look, I wasn't beeing greedy nor fearful. I simply entered a trade that took a while to make its target. Meanwhile, I kept managing my money by adjusting the stop exit. The GBP was moving without correlation with the EUR (nor the CHF), but it was going up and I did not want to chicken out of a trade just because it was taking its sweet time to resolve itself. It paid off, but if you read enough of my postings, you'll see that it could simply be a stopped out trade, one way or another, my goal was to manage the trade, the result is up to the market. +0.9% ROI

2) Short EUR/USD: Took the trade despite knowing there was a trend-line in the way. In a way, this was a mistake, but this was an old trend-line Wally showed us in the on-line chat room. Price DID oscilate around the trend-line, and I ended up scratching the trade when it approached 80% of the target and backed off. +0.33% ROI.

3) Short EUR/USD: After the consumer confidence announcement. The pressure was down, I entered when prices crossed a previous candle's low. I wanted to ride the trade for as much as it would give me, so I kept moving the stop. As it turns out, it bounced and hit my stop. Not a problem, it was already a win-win scenario. +0.14% ROI

Thursday, August 13, 2009

08/13 Day Trading FOREX

Just in time: I'm glad I narrowed my focus to the GBP/USD and EUR/USD currency pairs. I was too spread out by watching 4 pairs at once and it led to a bunch of execution mistakes. By reducing the number of pairs I watch, I can expand my FOCUS in execution and maintaining good trading ideas. It is a lot easier to stay in the flow if you track only a few pairs, you get a sense for how they're moving.

Let's talk about Today's trades:

1) Short GBP/USD: Noticed this break-out and reversal forming, didn't hesitate to enter, got in with a contingent order. Price oscilated before going to the target. It actually came short of triggering my limit stop, so when it started to go against me, I exited the position with a small profit. As it turns out, the GBP did reverse after that, so exiting and taking profits saved me from a loss. +0.15% ROI

2) Long EUR/USD: Out of nowhere, prices started FIRING up.. It all happened way too fast, but there was a trend-line breakout and retracement on the 5-min charts. Since it happened inside a 5 min. candle, I'm posting here the 1-min chart. I took my entry once price retraced from the high, and rode it to the target. +0.94% ROI

Wednesday, August 12, 2009

08/12 Day Trading FOREX - FMOC

1) Short EUR/USD: Right after the announcement, we made a low, retraced and I got in as soon as we started on a new low. This entry was made with an ENTRY order, that made it a lot easier for me. Wanted to go to the Fibo gap, but price started to retrace back up so I exited around B/E. +0.16% ROI

2) Re-entry Short EUR/USD: We made a retracement, I got in as soon as we started on a new low, exited a bit beyond the Previous Low. +1.2% ROI

08/12 Day Trading FOREX

I was able to regain control and traded beautifully during the FMOC meeting. Nothing like trading with a fresh mind-set and in the flow. But first, let's look at what I did this morning.. A word of warning, it wasn't pretty.

1) Short AUD/USD: Here I jumped the gun, the trade was not clear, I need things to happen in a certain sequence to validate an entry: 1) a break of the lower trend-line, 2) Retracement and 3) Continuation. This didn't happen here. -1% ROI

2) Long EUR/USD: Tried to get on this trade manually, jumped the gun again. Notice we never made a new high. I got in as price3 was approaching the entry. -1% ROI

3) Long EUR/USD: Good execution, this one I entered with an entry order. It got within 80% of the target, I exited as it faded back down to B/E. +0.15% ROI

Tuesday, August 11, 2009

08/11 Day Trading FOREX

First off, I managed to stay focused for most of the day, even as there was a loud beating noise due to construction here in the apartment. I stayed engaged with the trading room and called attention to several engulfing candles. These trades don't fit my entry criteria, so I didn't take them, but others in the room did.

I was also aware that we were approaching high points on the EUR/USD, GBP/USD and AUD/USD, and mentioned I was looking to SELL if we started to break down on my trendlines.

As it turned out, the market did sell off, but I only had a clear entry on the EUR/USD, I didn't take the trade because the 4150 level was in the way. I later discussed in the room, and some of the folks have been placing less emphasis on these levels and more on the round 00's. So I'll review price behavior around the 50's levels.

Lastly, I avoided a few trades that would end up being scratched because they had important support points ahead of them.

Well, as it turns out, the one trade I entered failed. Even so, I managed to properly get out as soon as it triggered my exit strategy (stop), others in the room took a much larger loss by hanging around with the trade.

1) Short EUR/USD: Took as the path seemed clear, the 10 AM announcement was over and the futures were pushing to new low points. EUR/USD halted and bounced back up. Exit properly as price passed the previous candle's high. -0.46% ROI

Monday, August 10, 2009

08/10 Day Trading FOREX

I took two losing trades Today, they ended up making to their original targets, but with a lot of hesitation and hitting my stops. I think the bottom line is that we did not have enough momentum in the markets this morning. I wanted to blog as soon as possible because I want to capture my thinking while it is hot..

There is still plenty of room for improvement in managing the stops. The new feature (or lack thereof) in the FXCM platform is making me trade a bit worse than before when it comes to managing to stop trades. My goal is to get out of the position once price breaches the previous candle's extreme (high if I'm selling, Low if I'm buying), however, with an entry order just a few pips above it, I hesitate and don't exit when price is hovering the exit. Before I could easily close the trade, now I have to close and cancel the stop entry order. I will keep on working on it this week...

a) Stop Management: C

b) Trade set-up: B

1) Short GBP/USD: We had a break with volume, a retracement and then the continuation. I took the continuation but prices went into a zig-zag consolidation.. Exit at the stop, not at the best level, but at the original stop. The best level to exit would have been right above the red candle that got me into the trade. -1.03% ROI

2) Short AUD/USD: This was really a sub-par trade, notice how the approach was full of hesitation.. Price was not moving with any force. Bad set up to begin with, and the stop was not properly managed. -1.15% ROI

Saturday, August 8, 2009

08/08 Weekly Review

Day-by-day review:

08/03: 2 trades, 1 win, 1 loss (-2.52% ROI)

08/04: 1 trade, 1 win (scratch) (+0.15% ROI)

08/05: 1 trade, 1 win (+3.04% ROI)

08/06: 2 trades, 2 wins (+8.46% ROI)

08/07: 1 trade, 1 loss (-1.46% ROI)

Totals for the week:

7 trades, 5 wins, 2 losses (+3.74% ROI - Not Compounded**)

Average Win: +3.04%

Average Loss: -2.56%

Risk to Reward Ratio: 1 : 1.2

Winning Percentage: 71%

Trading Performance Metrics:

1) Trade set-ups: A+ Waitted for the best trades, not rushing into sub-par trades

2) Managing Stops: A+ Managed properly, even with a change in the trading station

3) Capital Allocation: A- Need to adjust to the new capital level

4) Managing Exits: A+ Took all my trades to their targets

** I couldn't compound my capital this week because I was increasing my trading capital in the middle of the week. I started trading on a very small account on Monday, then increased on Wednesday and then again on Friday. Overall, I made good money for the week, the week P&L is based on the total capital available in the account by Friday.

Friday, August 7, 2009

08/07 Day trading FOREX

Here is the trade called in the teachmeforex trading room during the NFP announcement:

After missing this activity, I kept on looking for another entry opportunity, it didn't clearly materialize, and in fact, I may have jumped the gun on the only trade I took. As far as the technical analysis is concerned, I think it was a valid set-up, but there was a crucial factor missing: volume & speed.

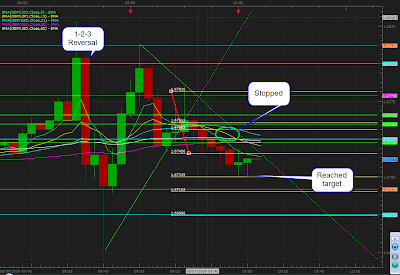

1) Short GBP/USD: I took this trade as a 1-2-3 reversal. It had broken the support trend-line and the SMA 50, it retraced and then triggered my entry on the short side. Then.... it failed to keep on pushing lower. Price simply sat there oscilating. I managed the stop by moving it down, GBP/USD hit the stop and then resumed in the desired direction. -1.46% ROI

Thursday, August 6, 2009

08/06 Day Trading FOREX

One way or another, I had two trades Today, they both worked fine.

Capital Allocation: A+ Properly allocated for the trade

Keeping Limits: A+

Stop Management: A+ Managed to add the stop and link as OCO to the limit

Trade Set-up: A+ Took the best set-ups in my mind.

1) Long GBP/USD: After crashing down 100 pips in less than 5 minutes, I expected the GBP/USD to retrace, I got this entry signal above the SMA21 and breaking the trend-line. Got in there and rode it to the target. +3.9% ROI

2) Short AUD/USD: After the US markets opened, we all noticed weakness in the S&P 500 futures, that brought the currency pairs down as it strenghtened the USD. So, took this short set-up on the AUD/USD and rode it to the target again. +4.39% ROI

Wednesday, August 5, 2009

08/05 Day Trading FOREX

So, long story short. there were a few set-ups that happened right at the announcement times, I avoid those as well, I used to trade announcements, but I no longer do, the stops are rarely honored and you may end up with a bigger than expected loss. Not to mention my broker "expands" the spread at the announcement times. So I wait for the dust to settle and if a set up is there, I then take it.

One more thing, I'm adjusting my trading capital and allocation targets for August, so the $ size of my trades are larger, but the % I risk per trade is smaller. I'm now trading 3% per trade.

1) Short AUD/USD: Took this trade after the 10:00 announcement, notice how we made it to the gap in no time. These set-ups are worth the wait! +3% ROI

Tuesday, August 4, 2009

08/04 Day Trading FOREX

I can't honestly say if it would be a win or a scratch, as I saw that Price did reach the fibonacci gap (price target), but I can't say for sure if it would trigger the limit order or if it would end up bouncing back down to b/e.

1) Long GBP/USD: Took it as the price broke the trend-line, there was room to move to the target, had to close the position because I was leaving and could not manage it. +0.15% ROI

Monday, August 3, 2009

08/03 Day Trading FOREX

From now on, I'm adding a new rule to avoid similar scenarios: Whenever a position goes to about 80% of the target, I should move my stop to scratch the trade at a small profit if we revert back down without hitting the limit. It simply doesn't make sense to watch price revert and give up all the profits on a shor reversal.

1) Long GBP/USD: Took the trade, as I mentioned, it moved in the right direction but stopped a few pips from my limit. Ended up taking a loss on it. -3.65% ROI

2) Long AUD/USD: Took this trade after the breakout and retracement. I got slipped in my entry and got long several pips above my entry price. I rode the trade to the target and got out, notice I only got 1/3 of my expected profit because of the entry. +1.18% ROI

Sunday, August 2, 2009

08/02 Weekly Review

I thought at first this was a negative week, as it turns out, it was a positive one. Once again, this is all thanks to a good capital allocation and risk to reward strategy coupled with decent execution on trading ideas/patterns. I'd like to point out that the risk : reward was not quite the 1:1 that I aim to achieve. This happened because in one of my trades I did not properly manage my stops, I let the trade hit the initial stop instead of cutting it short when it started to fade and revert (see 07/30). This is still a very small inventory of trades, however, it gives me something to focus on next week: managing stops.

Day-by-day review:

07/27 - No trading

07/28 - 2 trades, 1 win, 1 loss (-0.98% ROI)

07/29 - 1h trading day - 1 trade, 1 win (+3.5% ROI)

07/30 - 2 trades, 1 win, 1 loss (-0.45% ROI)

07/31 - No trading

Totals for the week:

5 trades, 3 wins, 2 losses. +2.02% ROI (Compounded)

Average Win = +3.5%

Average Loss = -4.09%

Risk to Reward ratio = 1.16 : 1

Winning Percentage = 60%

Trading Performance Metrics:

1) Trade set-ups: A- Had one single trade where I jumped the gun, all the others were properly set-up.

2) Managing Stops: B Want to make sure this is executed without hesitation. Focus on it next week

3) Capital Allocation: A+

4) Managing Exits: A+ Took all my trades to their targets

Friday, July 31, 2009

07/31 No trading Today

Once things get into gear the PM job will be done after trading, so everything will be back in its place. As much as I can, I'll trade, just as long as it is in the right time-frame. No sense in chasing pips..

Cheers!

Gustavo

Thursday, July 30, 2009

07/30 Day Trading FOREX

Capital Allocation: A+ Properly allocated for the trade

Keeping Limits: A+

Stop Management: C Did not manage it on the first trade

Trade Set-up: B Taking the first set-up was a mistake.

1) Short EUR/USD: Took the trade without waitting for a retracement, the breakout set-up is confirmed with a retracement and continuation. If it had retraced and then broken the low point highlighted in the chart, then it would be a good set-up. I also failed to adjust the stops, no good reason why, just got caught as a "deer staring at the headlights" mode. -4.17% ROI

2) Short EUR/USD: This was a great example of the same breakout pattern, notice we broke the trendline, moving averages and all the support lines in the chart. Made a clear retracement and then broke the low point. Took the trade without hesitation and rode it to its target. +3.87% ROI

Wednesday, July 29, 2009

07/29 Day Trading FOREX

Capital Allocation: A+ Properly allocated for the trade

Keeping Limits: A+ Sticking to a price target is extra difficult because I trade with a group and the folks there advocate for taking small profits. I've posted before regarding my strategy when it comes to risk : reward and taking profits. So I have to be confident in what I'm doing when everyone is jumping off the trade as soon as it moves 1 or 2 pips.

Stop Management: A+

Trade Set-up: A+ Spotted a good set-up and took it without hesitation.

1) Short EUR/USD: This was a 1-2-3 continuation trade, notice there was room to reach the target and no visible price support before the target. With that information I quickly added my lots and took the trade. +3.5% ROI.

Tuesday, July 28, 2009

07/28 Day Trading FOREX

I also want to point out that I have been extra conservative with my trading, there were several set-ups that I didn't take because they had some sort of support/resistance between my entry and the profit targets. Eventually they made their way, however, not the usual clear cut that happens when the path is clear. I pasted an example of a trade I didn't take Today.

Capital Allocation: A+ Properly allocated for the trade

Keeping Limits: B Limit was not properly set up on the second time I took the trade

Stop Management: A+

Trade Set-up: A- Spotted a good set-up and took it, got whipsawed the first time.

1) Short GBP/USD: Took the sell twice, the first time got whipsawed (-4.02% ROI), the second made it to the target (+3.17% ROI). At the second entry my limit was a few pips off the target, so it didn't quite fully recover from the first trade.

a) Short EUR/USD: We had the 4250 in the way to the target, see how it bounced from there, this bounce could have hit my stop. Assuming it didn't hit the stop, it took the EUR/USD 15 to 20 minutes working through the barriers. In the trade above, we got to the target in 7 minutes

Monday, July 27, 2009

07/27 - No trading

For my test Today I took a couple of good set-ups that simply fizzled and failed. I was using test money and don't want to mess up my performance adjusting to a different trading time/volume. So, it is better to miss a few sessions and come back whenever possible than it is to try adjusting to an environment that is completely different.

I'll be trading in and out this week, will be posting whenever I can trade.

Cheers!

Gustavo

Saturday, July 25, 2009

07/25 Weekly Review

Day-by-day review:

07/20 - 4 trades, 1 win, 3 losses. -0.97% ROI

07/21 - 3 trades, 1 win, 2 losses. -4% ROI

07/22 - 2 trades, 1 win, 1 loss. -1% ROI

07/23 - 1 trade, 1 win. +3.71% ROI

07/24 - 1 trade, 1 win. +3.6% ROI

Totals for the week:

11 trades, 5 wins, 6 losses. +0.73% ROI (Compounded)

Winning Percentage = 45%

07/25 Anatomy of a Recovery

It takes a lot of effort not to let a string of losing trades spiral out of control, it takes more effort to not let a string of negative days to turn into a negative week. For me, I had to look at myself first, then review my trades and finally make the turn. So, I decided to write this and outline what I did.

First I had to look at myself. Was I trading on my best mood? Best focus? NO, once I realized, I then took a look at what I could do to fix it, like any machine operating under stress, it usually breaks down. This is my case with my own body. I was having a hard time sleeping and was not doing any form of excercise, not to mention eating a lot of white bread. So, I fixed all 3 items on Wednesday: I went running on the beach early in the morning, that gave me energy and focus for the trading day, I fixed my breakfast to remove the white bread and replaced with an Acai shake with banana and oatmeal, I also started reading at night instead of watching TV. That took care of the body.

Also Wednesday, around 8 PM, I was still very focused and took a look at my trades. I realized my failing trades were break-out trades from the top or bottom of channels, then I looked at the market and realized we were in a very tight channel and I should be extra careful not to sell at the bottom nor buy at the top (see posting). This was most important for the turn-around, but it would never come to me if I hadn't "observed" my own self first.

Last, but not least, another key component is the fact that I'm trading with a decent risk to reward ratio. By keeping a 1 to 1 risk to reward (see posting), I ensure that I'm able to be profitable even if my win-ratio is slightly over 50%. If I was trading with a non-favorable risk to reward ratio, a string of losses would be enough to put me back in the red for quite a while.

All that being said, I hope this helps me in future similar situations. Also hope it helps others if they find themselves going through a rough trading time.

Cheers!

Gustavo

Friday, July 24, 2009

07/24 Day Trading FOREX

Capital Allocation: A+ Properly allocated for the trade

Keeping Limits: A+

Stop Management: A+

Trade Set-up: A+ Spotted the set-up and kept an eye on it to make sure I was there to catch when it developed

1) Short GBP/USD: This was a reversal pattern, see how price punched the SMA 21 and then retraced to bounce back down. Following the suggestion from a fellow trader (George) I got in a few pips after it broke bellow the 6450 price level, just to be sure it cleared before I got in. +3.6%

Thursday, July 23, 2009

07/23 Video on win-ratio and risk to reward

http://www.youtube.com/watch?v=bqdB53zCa7A

In a nutshell, the math is very simple. If you put together a very simple spreadsheet, you'll see that if you take small wins, and accept a much larger loss, you'll need to win a much higher percentage of times in order to make money at the end of the day, the week, the month.

On the other hand, if your wins are bigger than your losses, you don't need to be right a lot of times in order to make money at the end of the day, the week, the month.

It is part of the human phsychology to avoid losses. So, it is normal that a person will gravitate towards taking smaller profits, so they lose less often. However, look at the spreadsheet bellow (click to zoom), you'll see that the right thing to do is not to feel confortable with your wins, but set yourself up with a decent risk-to-reward ratio, so that your losses are not going to hurt you as much. Just to be clear, you will still HATE your losses no matter how small they are, but in the end of the day, you'll be making money.

I've been trading with a 1:1 win:loss ratio, that means if I take a bad trade, all I need is a good trade to recover. It is a lot easier to control capital allocation and risk:reward ratio than it is to trade with a set-up that has over 90% of win-ratio. If you have both, then FANTASTIC, you have a great risk:reward and a great win-ratio, you don't need anything else in life, just to keep doing what you're doing. :)

For my own trading, I've seen my win-ratio around the 68% mark for the good weeks and bellow 50% on the rough weeks. However, I am working consistently in keeping the risk:reward to at least 1:1. In many occasions I'm able to manage the stops on losing trades, reducing their costs and making the risk:reward even better than 1:1. In the long run, I like my odds of making money consistently starting with a decent risk:reward, then moving on to improving the win-ratio.

Like Richard Regan suggests on his video, it is much harder to achieve and sustain a very high win-ratio.

I hope this helps.

Cheers!

Gustavo

07/23 Day Trading FOREX

Capital Allocation: A+ Was able to quickly calculate and allocate the propper number of lots

Keeping Limits: A+

Stop Management: A+

Trade Set-up: A+ Specially great Today, as I avoided at least two trades that would have failed on me.

1) Long GBP/USD: Took the trade as I was about to exit the session, noticed that we had a clear path to the target and didn't hesitate to enter the position. +3.71%

Wednesday, July 22, 2009

Rough week so far

07/22 Day Trading FOREX

I also went for a run at the beach this morning, it helps me by giving an extra energy reserve, allowing me to stay focused longer and to not fall into a blame-game when a whipsaw takes me out of a good set-up, like it happened Today. If I don't excercise early in the morning, I end up needing more coffee to stay alert, then it triggers anxiety.. My trading is a lot smoother when I have time to do some morning workout activity

Capital Allocation: B -- I misscalculated the Size of the GBP/USD profit target, took it with 1 extra lot on the first time.

Keeping Limits: A+

Stop Management: A+

Trade Set-up: B -- I missed a great set-up on the AUD/USD, also got whipsawed on a good GBP/USD trade.

Daily Result: -1%

1) Short GBP/USD: Whipsawed and got into the trade by a fraction of a pip, ended up hitting my stop. -4.03%

2) Short GBP/USD: Took the same entry, now it worked. It did however take some heat on its way down, the GBP wasn't moving fast during this time. +3.15%

Tuesday, July 21, 2009

07/21 % ROI & Capital Allocation

I subscribe to a pre-defined money and risk management approach, and the results are just easier to publish if I note the trading account ROI.

Here is what I am currently doing as far as capital allocation: TRADING SMALL. I'm not trading aggressive during these summer months, we've been in a tight range for quite a while now. I'm currently allocating a small % of my capital to Forex trading, and out of that %, only 1/10th is actually available in my trading account.

So, if you see in the blog an ROI of + or - 4% for instance, keep in mind it is 1/10th of my trading capital, therefore, this is really 0.4% per trade. Hope that helps to keep things in perspective

07/21 Day Trading FOREX

Capital Allocation: A+

Keeping Limits: A+ I almost closed the winning AUD/USD trade sooner than the target, but stayed with the trade as planned.

Stop Management: A+

Trade Set-up: C Took two trades that were not the best, one was without the retracement, the second bad trade was against a strong trend.

Daily Result: -4%

1) Short USD/CAD: I took this trade without waitting for a decent retracement, as it happened, "I took the retracement" and it hit my stop. This same set-up at the lower point worked after it retraced. -3.58%

2) Long AUD/USD: I took this as a 1-2-3 continuation, there was room at the top and it made the target. There was some hesitation but not enough to keep price from moving up. +2.97%

3) Long USD/CAD: Took this trade, it was against a strong down-trend, and I thought we'd reverse, bad thinking. It hit my stop right away. -3.4%

Monday, July 20, 2009

07/20 Day Trading FOREX

Capital Allocation: A+ (properly allocated in all trades)

Keeping Limits: A+ (kept limits in all trades)

Stop Management: A+ (managed stops properly in all trades)

Trade set-up: A+ (used confirmation in all trades)

Day's P&L Result: -0.97%

1) Long GBP/USD: This was the first trade for the day, it went positive but then reverted back down hitting my stop. Target was 10 pips, I took it with 3 lots. -2.57%

2) Long AUD/USD: This was a test of sticking with limits, the trade went 1 pip short of the target, when it faded I scaled out 1/2 by closing, kept managing the stop for the remaining 1/2, once again it went short 1 pip of the target and closed at the stop. 8 pip target, used 4 lots. -0.05%

3) Short GBP/USD: Great trade, the best of the day. I called in the room, went right to the target. 8 pips target, used 4 lots, +3.7%